|

November 13, 2015

China Gold International Reports 2015 Third Quarter Results.

VANCOUVER, November 13, 2015 - China Gold International Resources Corp. Ltd. (TSX: CGG; HKEx: 2099) (the �Company� or �China Gold International Resources�) is pleased to report financial and operational results for the three months (�Q3�, �quarter� or �third quarter 2015�) ended September 30, 2015. The Company updates copper production outlook.

Selected Highlights: Q3 of 2015 Compared to Q3 of 2014

- Consolidated revenues of US$99.9 million for the third quarter of 2015 increased by US$10.6 million or 12%, from US$89.3 million for the same time period in 2014.

- Jiama Mine�s revenues of US$37.5 million for the third quarter of 2015 compared to US$35.4 million for the same time period in 2014 due to a 31% increase in total copper sold from 10.84 million pounds in Q3 of 2014 to 14.2 million pounds in Q3 of 2015.

- Copper production from the Jiama Mine for the third quarter of 2015 decreased by 8% to 8.7 million pounds from 9.4 million pounds for the same period in 2014 mainly due to lower grade ores mined during the current period.

- CSH Mine experienced higher revenues of US$62.4 million for the third quarter of 2015 versus US$53.9 million for the same time period in 2014 due to 30 % increase in gold sales volume. Gold sold by the CSH Mine was 56,741 ounces for the third quarter of 2015, compared to 43,799 ounces for the same period in 2014.

- Gold production at the CSH Mine increased to 57,981 ounces for the third quarter of 2015, from 48,124 ounces for the for the same time period in 2014 primarily due to the completion of the mine expansion program doubling the mine capacity from 30,000 tpd to 60,000 tpd in October 2014.

- Consolidated mine operating earnings of US$17.2 million in Q3 of 2015 decreased by 47% or US$15.4 million, from US$32.6 million for the same time period in 2014. The decrease in mine operating earnings can be attributed to the declines in the realized average prices of gold and copper.

- Consolidated general and administrative expenses of US$5.3 million in Q3 of 2015 decreased by US$0.2 million, from US$5.5 million for the same time period in 2014 as a result of the company-wide cost reduction plan.

- Consolidated income from operations of US$11.8 million in Q3 of 2015 decreased by US$15.1 million, from US$26.9 million for the same time period in 2014.

- Foreign exchange loss increased to a loss of US$8.6 million for the three months ended September 30, 2015 from a loss of US$0.3 million for the same 2014 period. The 2015 loss is related to the revaluation of monetary items held in Chinese RMB and Hong Kong Dollars, which was based on changes in the RMB/HKD/USD exchange rates. During August 2015, The People�s bank of China depreciated the RMB by approximately 3% against the US dollar in an effort to correct exchange rate misalignment.

- Net loss of the Company was US$5.2 million for the third quarter of 2015, compared to a net income of US$16.4 million for the same time period in 2014.

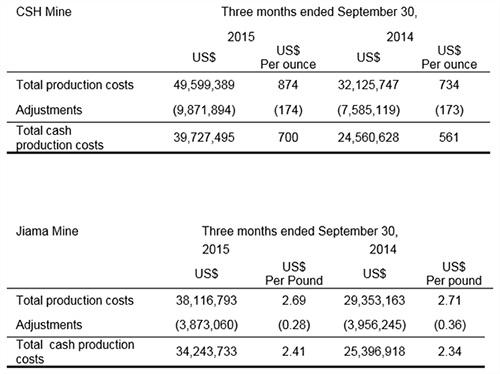

- At CSH Mine, the cash production cost, and total production cost of gold for the three months ended September 30, 2015 both increased compared with the same period in 2014 due to the higher waste rock removal costs as a result of the higher stripping ratio during the current quarter.

- At Jiama Mine, the cash production cost of copper per pound increased due to the higher mining costs due to lower grade of ore during the current period. The total production costs of copper per pound slightly decreased due to less depreciation and amortization expenditures included in the production costs.

Production costs above include expenditures incurred on the mine sites for activities related to production. The adjustments above include depreciation and depletion, amortization of intangible assets, and selling expenses included in total production costs.

Recent Developments and Future Outlook

- The Jiama Mine�s Phase II expansion is being executed in two stages. Stage I has been completed and is now in test run, at a throughput capacity of 28,000 tpd, up from the previous capacity of 6,000 tpd. Stage II of the project is under way and is expected to be commissioned in the second half of 2016, increasing capacity to 50,000 tpd..

- On March 15, 2015, the Company reported expected 2015 copper production guidance to be 53 million pounds. The Company revises this guidance to 40.5 million pounds. This is a 31% increase from the 2014 actual copper output of 31 million pounds. The downward revision of the forecast is due to the delayed grant of the mining license for the Phase II expansion project. The license was received on October 12, 2015. The delay was caused by recent adjustments in the review and approval procedures within state-level supervisory bodies.. At the moment, the Company is applying for a permit to commission the Phase II production and a safety permit to enter into commercial production.

- Projected gold production of 226,000 ounces in 2015.

- On November 3, 2015, The Company announced that Tibet Huatailong Mining Development Corp. Ltd. (�Tibet Huatailong�), the Company�s wholly-owned subsidiary, entered into a Loan Facility Agreement with a syndicate of banks (�The Lenders�), for the aggregate principal amount of RMB3.98 billion, approximately US$627 million. The syndicate of banks include the Bank of China as the �Lead Manager�. In addition to the Lead Manager, other Lenders consisted of Agricultural Bank of China, China Construction Bank and Bank of Tibet. The Loan Facility is subject to a floating rate, currently set at 2.83% per annum, set by the People�s Bank of China Lhasa Center Branch�s interest rate benchmark, discounted by 7 basis points (or 0.07%). Repayment of the Loan Facility is scheduled to begin in May 2019 and will reach full maturity and repayment in November 2029. The proceeds of the Loan Facility are to be used for the development of the Company�s Jiama Copper-Gold Polymetallic Mine.

For a detailed look at the complete set of the financial statements and MD&A analysts, investors, media and general public are encouraged to visit the Company�s website at http://www.chinagoldintl.com/investors/financials, SEDAR at www.sedar.com or The Stock Exchange of Hong Kong Limited at www.hkex.com.hk or contact the Company with any questions.

About China Gold International Resources

China Gold International Resources Corp. Ltd. is based in Vancouver, BC, Canada and operates both profitable and growing mines, the CSH Gold Mine in Inner Mongolia, and the Jiama Copper-Polymetallic Mine in Tibet Autonomous Region of the People�s Republic of China. The Company�s objective is to continue to build shareholder value by growing production at its current mining operations, expanding its resource base, and aggressively acquiring and developing new projects internationally. The Company is listed on the Toronto Stock Exchange (TSX: CGG) and the Main Board of The Stock Exchange of Hong Kong Limited (HKEx: 2099).

For additional information:

Elena M. Kazimirova

Investor Relations Manager and Financial Analyst

Tel: +1.604.695 5031

Email: info@chinagoldintl.com

Website: www.chinagoldintl.com

Cautionary Note About Forward-Looking Statements

Certain information regarding China Gold International Resources contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. Although China Gold International Resources believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. China Gold International Resources cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what China Gold International Resources currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and subject to change after that date.

View PDF |